News List

GST Council Reduces Logistics Service Tax to 12%, Boosting Trucker Margins

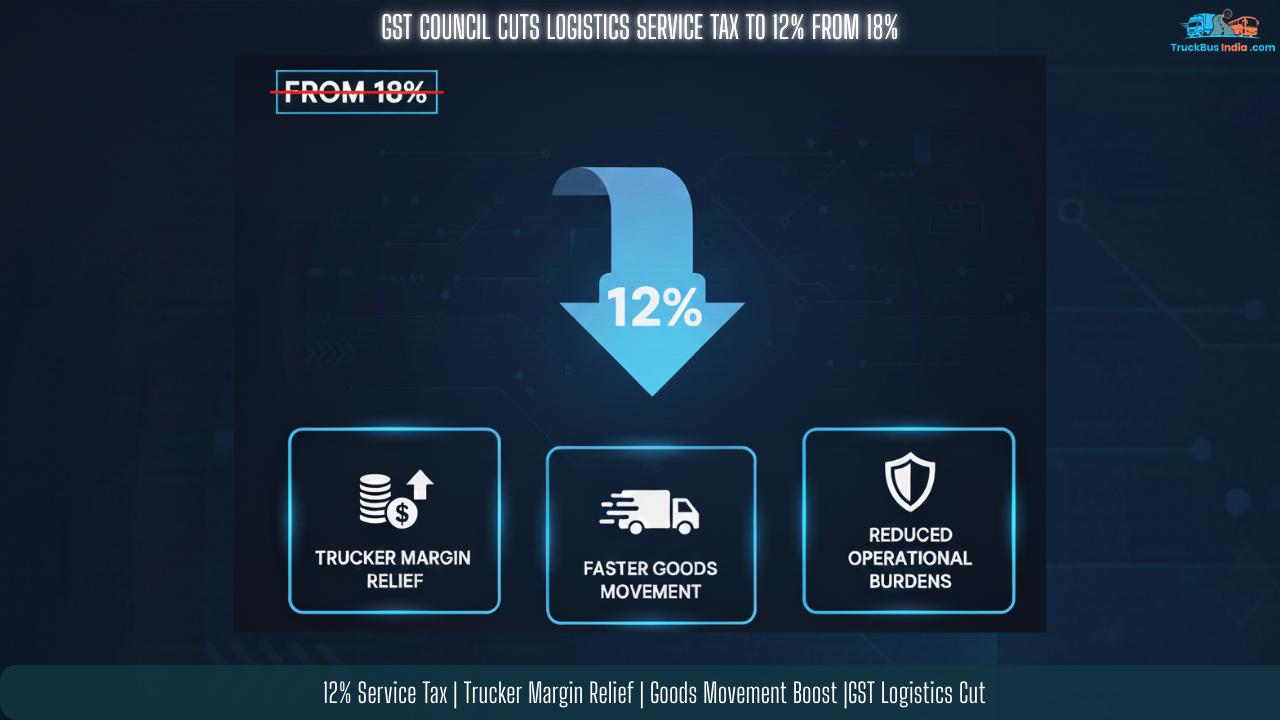

In a major policy move aimed at enhancing efficiency in the transport and logistics sector, the GST Council has approved a reduction in the Goods and Services Tax (GST) on logistics services from 18% to 12%. This cut is expected to provide significant financial relief to trucking operators while facilitating faster movement of goods across the country.

Financial Relief for Truckers

Trucking operators have long expressed concerns over high service tax rates, which increase operational costs and reduce profit margins. With the new 12% service tax, truckers can now enjoy a lower tax burden, directly translating into improved margins. This step is particularly beneficial for small and medium logistics operators, who form the backbone of India’s freight network. The reduced GST not only lowers the cost of moving goods but also enhances the competitiveness of domestic logistics services.

Boosting Goods Movement

The logistics sector plays a critical role in India’s supply chain ecosystem. Faster and more cost-efficient transport ensures timely delivery of goods, reduces inventory costs, and strengthens the overall economic cycle. By cutting GST on logistics services, the government is sending a clear signal that it prioritizes efficiency and sustainability in the freight sector. The rate reduction is expected to encourage more businesses to opt for formal logistics channels, thereby increasing compliance and transparency across the industry.

Impact on Operational Costs

The reduction from 18% to 12% is a 6% decrease in the tax rate, which can significantly reduce operational costs for trucking companies. For long-haul operators, fuel costs and tolls constitute major expenses, and any reduction in service tax contributes directly to profitability. Analysts suggest that this cut could also enable fleet operators to invest in newer, more efficient vehicles, adopt technology-driven fleet management solutions, and improve overall service quality.

Encouraging Sector Growth

The logistics sector is poised for rapid growth, driven by e-commerce, retail expansion, and government initiatives like Bharatmala and dedicated freight corridors. The GST logistics cut is expected to stimulate further investment in this sector, particularly in technology, fleet modernization, and last-mile delivery infrastructure. By easing the tax burden, the government aims to attract more organized players, reduce bottlenecks, and support the development of a seamless transport ecosystem across India.

Industry Reactions

Industry experts have welcomed the GST reduction as a “long-awaited and necessary step” for the logistics industry. Trucking associations have highlighted that the move will not only improve trucker earnings but also incentivize adherence to formal regulatory frameworks. Businesses engaged in supply chain operations are optimistic that lower service tax rates will enhance operational predictability, reduce costs, and ultimately benefit consumers through faster and more reliable deliveries.

Conclusion

The GST council’s decision to reduce the logistics service tax from 18% to 12% marks a significant milestone for India’s freight sector. By providing trucker margin relief and lowering operational costs, the government is fostering an environment conducive to faster goods movement and sectoral growth. This policy change reinforces India’s commitment to strengthening its logistics infrastructure, supporting economic growth, and ensuring that supply chains operate efficiently in an increasingly competitive global market.