News List

Brand-Wise E-Rickshaw Market Share: April–November 2025 Overview

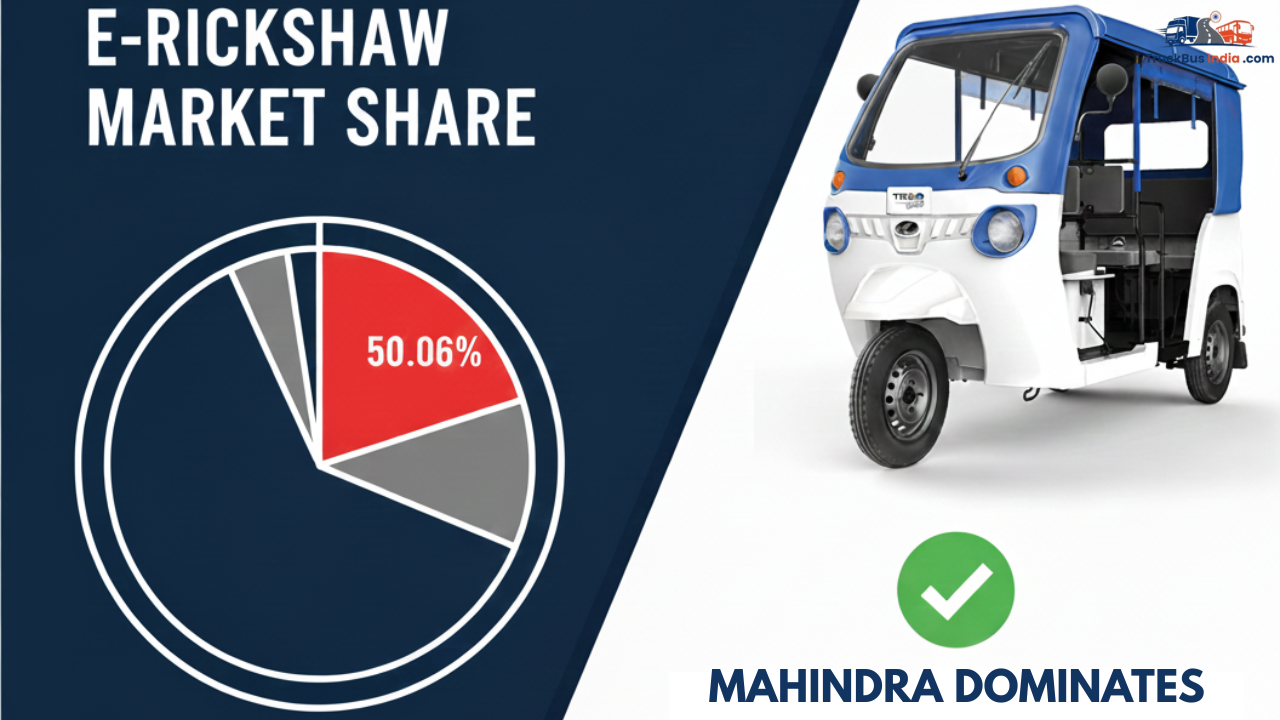

The Indian e-rickshaw market continues its rapid growth in 2025, driven by demand for affordable, emission-free last-mile transport. According to industry data, Mahindra dominates the brand-wise e-rickshaw market share with an impressive 50.06% of sales from April to November 2025 — maintaining a clear lead despite competitive pressures from other manufacturers.

E-rickshaws — a subset of electric three-wheelers (EV 3W) — play a central role in India’s EV ecosystem, offering cost–efficient mobility for both passengers and goods on short routes. With supportive government policies and rising urbanisation, these vehicles are reshaping last-mile connectivity in towns and cities.

Mahindra’s Continued Dominance

Mahindra’s leadership at 50.06% market share for April–November 2025 underscores its strong positioning within the e-rickshaw category. This dominant share suggests that over half of all e-rickshaws sold in this period came from Mahindra-branded models.

The company has leveraged its strong distribution network, established brand credibility, and diverse EV 3W portfolio to capture this leading position. Its range typically includes popular offerings like the Mahindra Treo and e-Alfa series, which are favored for reliability and low cost of ownership.

This dominance also reflects Mahindra’s strategic focus on last-mile electric mobility — long before many rivals pivoted aggressively into this segment — giving it early mover advantage and customer loyalty across many regions.

Competitive Landscape: Other Key Brands

Although Mahindra leads by a significant margin, the e-rickshaw market remains crowded with hundreds of manufacturers, ranging from niche players to household automotive brands.

Other notable contenders include:

- YC Electric — frequently among the top performers in monthly registration data, especially for passenger e-rickshaws.

- Saera Electric and Dilli Electric — holding meaningful niche shares with focused regional demand.

- New entrants and smaller OEMs — contributing to a vibrant, fragmented ecosystem driven by local demand and government incentive schemes.

Even with these competitors, Mahindra’s share suggests a concentrated market where one brand manages a dominant footprint amidst broad participation.

Market Dynamics Driving Growth

Rising EV Adoption and Sales

The overall electric three-wheeler industry in India has been witnessing robust growth in 2025, with cumulative EV 3W sales crossing significant milestones and setting year-to-date records.

This broader trend in electric three wheeler sales reflects improved consumer acceptance, supportive state policies, and operating economies that appeal to drivers and fleet operators alike. As fossil fuel prices fluctuate, electrification of last-mile transport has become increasingly appealing.

Government Policy Support

India’s EV policy frameworks — such as subsidy schemes and infrastructure support — have bolstered uptake across EV segments, including e-rickshaws. These incentives reduce the upfront cost burden and accelerate electrification in urban and semi-urban contexts.

Urbanisation and Last-Mile Demand

Urban transport challenges, including congestion and pollution, have made e-rickshaws a preferred solution for last-mile connectivity. Their affordability and adaptability for short passenger routes or goods delivery further cement their relevance.

What This Means for the E-Rickshaw Market

Mahindra’s market dominance in the e-rickshaw sector illustrates how early investment, expansive product portfolios, and dealer networks translate into leadership in emerging EV segments. As the e-rickshaw market in India expands, competition will likely intensify, with legacy OEMs and startups alike striving for impactful share gains.

Yet, Mahindra’s stronghold underscores the advantage of brand trust and first-mover strategies in the fast-evolving electric three wheeler sales landscape.