News List

India Construction Equipment Sales Fall in 2025

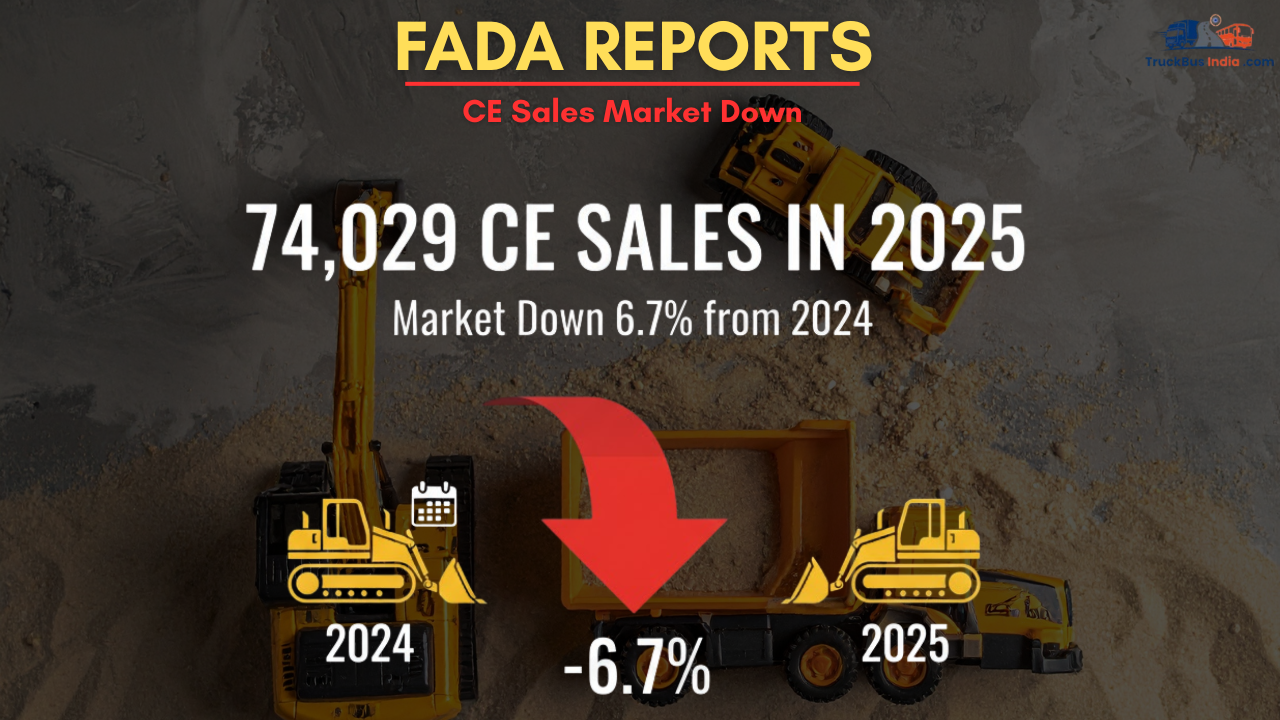

India’s construction equipment market witnessed a slowdown in 2025, with retail sales declining by 6.67% year-on-year (YoY), according to the latest data from the Federation of Automobile Dealers Associations (FADA). A total of 74,029 units were sold across the country, down from 79,316 units in 2024, highlighting a cautious year for the sector.

JCB India Limited continued to dominate the market, retaining its top position with 34,833 units sold. However, the company faced a 13.68% YoY decline compared to 40,351 units in 2024. Similarly, Caterpillar India Pvt Ltd reported a drop in sales to 1,762 units from 2,085 units in the previous year, marking a 15.49% decline.

Among mid-sized players, Action Construction Equipment Ltd (ACE) saw sales dip to 8,269 units in 2025, down 6.85% from 8,877 units in 2024. Escorts Kubota Limited also reported a fall in sales, delivering 4,723 units during the year, a 13.75% decrease from 5,476 units in 2024.

On the positive side, a few manufacturers recorded growth. AJAX Engineering Ltd posted an 8.06% YoY rise, selling 4,879 units, up from 4,515 units in 2024. CASE New Holland Construction Equipment (India) Pvt Ltd also saw healthy growth, with sales reaching 2,034 units, up 10.42% from 1,842 units. Tata Hitachi Construction Machinery Company Pvt Ltd grew 6.96%, delivering 2,014 units, while Bull Machines Pvt Ltd posted a remarkable 27.25% YoY increase with 1,723 units sold.

The All Terrain Crane segment emerged as a standout performer, registering a 38.74% YoY growth with 1,522 units sold, up from 1,097 units in 2024. Liugong India Pvt Ltd mirrored this growth trajectory, recording 1,196 units, a 38.59% rise compared to 863 units a year ago. Other players like Mahindra & Mahindra Limited experienced a slight decline of 5.79%, selling 1,172 units, while Schwing Stetter (India) Private Limited saw a modest 1.27% increase to 1,117 units.

The “Others” category, which includes OEMs with less than 1% market share, grew 1.84% YoY to 8,785 units.

FADA noted that the data, collated in collaboration with the Ministry of Road Transport & Highways, reflects sales from 1,401 out of 1,459 RTOs and does not include figures from Telangana.

Overall, while market leaders like JCB and Caterpillar faced declines, niche segments such as All Terrain Cranes and players like Bull Machines and Liugong showed promising growth, indicating shifting dynamics in India’s construction equipment industry.