News List

Ind-Ra predicts gradual CV recovery as LCVs lead, MHCVs stay infra-dependent

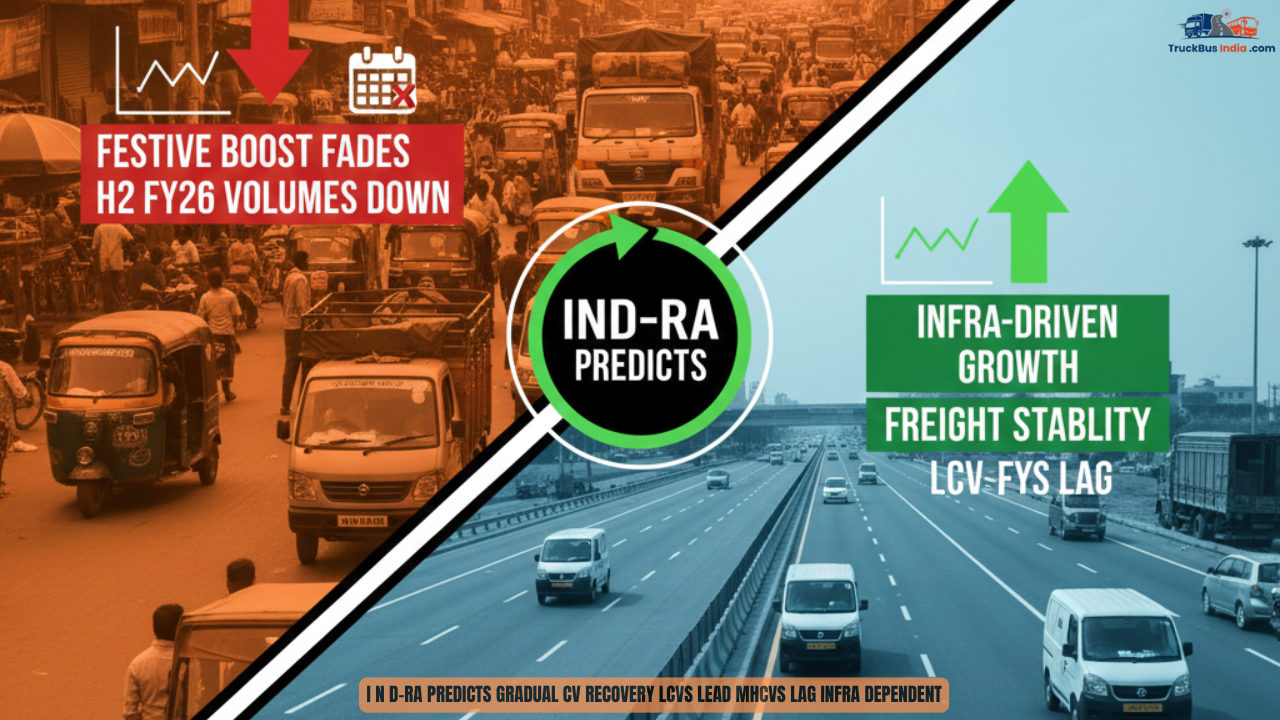

India’s commercial vehicle (CV) market is set for a measured and uneven recovery, according to India Ratings and Research (Ind-Ra). While near-term festive demand has softened, the ratings agency expects light commercial vehicles (LCVs) to lead volume growth through H2 FY26, even as medium and heavy commercial vehicles (MHCVs) remain closely tied to infrastructure execution and freight momentum.

Festive boost fades, revealing underlying demand trends

After a brief festive-season uptick, CV sales momentum has moderated. Ind-Ra notes that festive demand increasingly offers only short-lived volume support, rather than sustained growth.

Key reasons include:

- High base effects from previous years

- Selective fleet purchasing amid cost pressures

- More disciplined inventory management by OEMs and dealers

This slowdown, however, does not indicate a downturn. Instead, it highlights a transition toward structural demand drivers, particularly in the LCV segment.

LCVs emerge as the primary growth engine

According to Ind-Ra, LCVs are best positioned to drive CV market recovery in 2025–26. Demand for small trucks is being supported by:

- E-commerce and last-mile logistics

- FMCG and retail distribution

- Urban and semi-urban freight movement

LCVs benefit from faster turnaround, lower operating costs, and wider use across sectors. Their versatility allows them to perform well even when large infrastructure-linked freight is uneven.

This explains why LCV MHCV sales forecasts increasingly diverge, with LCVs showing steadier volume visibility.

MHCV recovery hinges on infrastructure execution

In contrast, MHCV demand remains infrastructure-dependent. Ind-Ra highlights that heavy truck volumes are closely correlated with:

- Road and highway project execution

- Mining activity

- Large-scale construction and cement movement

While government capital expenditure remains strong on paper, actual MHCV demand depends on project rollout speed and payment cycles. Any delay in execution directly impacts freight movement and new truck purchases.

As a result, MHCV recovery is expected to be gradual rather than sharp, even as long-term fundamentals remain intact.

Freight stability supports downside protection

A key stabilising factor for the CV market is freight rate stability. While rates have not surged, they have largely avoided sharp declines, helping fleets maintain cash flows.

Ind-Ra points out that:

- Stable freight rates support replacement demand

- Improved road infrastructure reduces turnaround times

- Better fleet utilisation offsets volume volatility

This stability is particularly important for small fleet operators, who dominate India’s trucking ecosystem.

Replacement demand drives baseline volumes

Across segments, replacement demand continues to anchor CV sales. Ageing fleets, rising maintenance costs, and compliance requirements are pushing operators to upgrade vehicles even in a cautious demand environment.

For LCVs, replacement cycles are shorter due to higher urban usage. For MHCVs, replacements are more selective but inevitable as vehicles age and efficiency expectations rise.

Cost pressures shape buying behaviour

Input costs, interest rates, and total cost of ownership remain key decision factors. Ind-Ra notes that fleet operators are:

- Delaying discretionary purchases

- Opting for fuel-efficient or application-specific models

- Exploring alternative financing structures

These dynamics reinforce why recovery will be incremental rather than explosive.

What Ind-Ra’s commercial outlook signals for OEMs

For manufacturers, Ind-Ra’s outlook suggests a need for segment-specific strategies:

- Focus on LCV portfolio refreshes and logistics partnerships

- Target MHCV sales around confirmed infrastructure corridors

- Balance production to avoid inventory build-up

OEMs with strong LCV exposure and diversified customer bases are likely to outperform peers heavily dependent on cyclical MHCV demand.

Gradual recovery, not a demand shock

The key takeaway from Ind-Ra’s analysis is clear: India’s CV market recovery will be steady, not sudden. LCVs will continue to provide volume resilience, while MHCVs wait for sustained infrastructure execution to unlock full growth potential.

As FY26 unfolds, the sector’s performance will hinge less on festivals and more on freight economics, infrastructure momentum, and replacement cycles — setting the stage for a disciplined, fundamentals-driven recovery.