News List

E-rickshaw slump accelerates as L5 cargo autos dominate last-mile economics

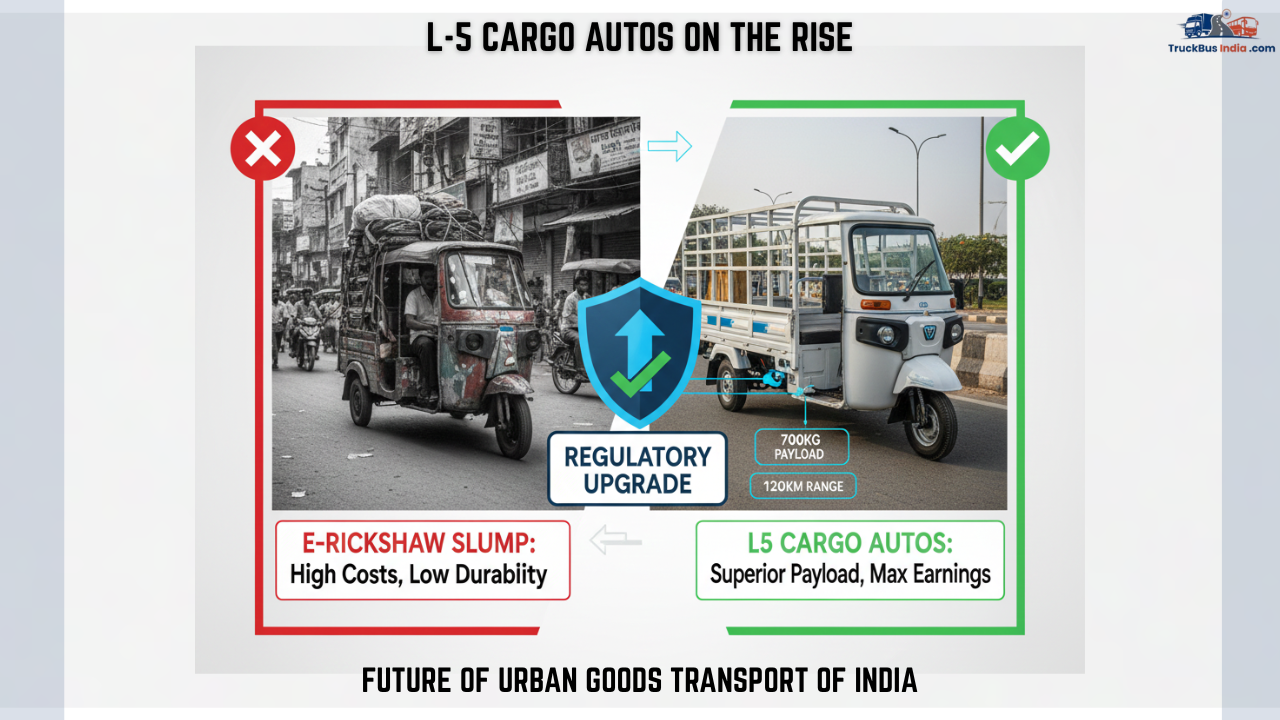

India’s last-mile transport market is undergoing a sharp reset. Once the backbone of affordable urban mobility, low-speed e-rickshaws are rapidly losing ground as operators pivot toward L5 electric cargo autos. Tighter regulations, rising compliance costs, and changing urban delivery economics are driving what industry watchers describe as a structural shift rather than a temporary slowdown.

Regulatory upgrade squeezes entry-level e-rickshaws

The biggest trigger behind the e-rickshaw slump is regulation. Over the past two years, authorities have tightened norms around vehicle approval, safety, and registration, especially in large cities. Informal, low-cost e-rickshaws — many of which earlier operated with minimal documentation — are now being phased out.

Key regulatory pressures include:

- Mandatory vehicle registration and permits in more urban zones

- Enforcement of homologation and safety standards

- Restrictions on unregistered vehicles in city centres and arterial roads

These changes have pushed up acquisition and compliance costs, eroding the price advantage that made e-rickshaws popular with first-time drivers. As a result, fleet owners and individual operators are re-evaluating return on investment.

Why L5 cargo auto sales rise across cities

In contrast, L5 category electric cargo autos — higher-speed, fully homologated three-wheelers — are gaining rapid acceptance. Designed for commercial freight rather than passenger movement, L5 cargo vehicles offer a stronger economic proposition in today’s urban logistics environment.

Key advantages driving adoption:

- Higher payload capacity compared to traditional e-rickshaws

- Longer range per charge, reducing downtime

- Eligibility for formal financing and insurance

- Compliance with city permits and zoning rules

With the explosion of e-commerce, quick-commerce, and hyperlocal delivery, demand has shifted toward vehicles that can carry more, move faster, and operate legally across multiple city zones.

E-rickshaw replacement trend reshapes driver choices

For drivers, the shift is increasingly pragmatic. While e-rickshaws remain cheaper upfront, their limited speed, payload, and route access restrict earning potential. L5 cargo autos, though more expensive initially, enable:

- More trips per day

- Access to higher-value delivery contracts

- Reduced risk of fines or vehicle seizure

This has accelerated the e-rickshaw replacement trend, particularly in metros and Tier-1 cities, where enforcement is strict and delivery demand is dense.

Financing shift removes a key adoption barrier

One of the most decisive factors behind the three-wheeler market pivot is financing. Banks and NBFCs are increasingly reluctant to fund informal or low-speed e-rickshaws. In contrast, L5 cargo autos qualify for structured loans, subsidies, and fleet leasing models.

This financing shift lowers the effective ownership cost of L5 vehicles and makes them accessible even to small operators. OEM-backed finance, battery warranties, and service contracts further strengthen buyer confidence.

Urban permit changes favour cargo over passenger

Another under-reported driver of change is urban permit policy. Several cities are capping passenger e-rickshaw permits to manage congestion, while simultaneously encouraging electric cargo vehicles to support clean logistics.

Cargo autos face:

- Fewer route restrictions

- Higher utilisation in commercial zones

- Better alignment with municipal sustainability goals

This regulatory bias is nudging operators away from passenger movement and toward freight, where policy support and revenue visibility are stronger.

What this means for the three-wheeler market

The decline of entry-level e-rickshaws does not signal a slowdown in electrification. Instead, it marks a maturation of the electric three-wheeler ecosystem. Manufacturers are focusing on durable platforms, higher-energy batteries, and telematics-enabled vehicles suited for professional use.

Industry analysts expect:

- Continued growth in L5 cargo auto sales

- Consolidation among low-quality e-rickshaw makers

- Greater fleet participation in last-mile logistics

In summary, rising compliance costs may have stalled the cheapest models, but they have also paved the way for a more sustainable, economically viable last-mile transport system — one where L5 electric cargo autos are clearly in the driver’s seat.