News List

India’s E‑rickshaw boom fades as L5 safety rules double upfront vehicle costs

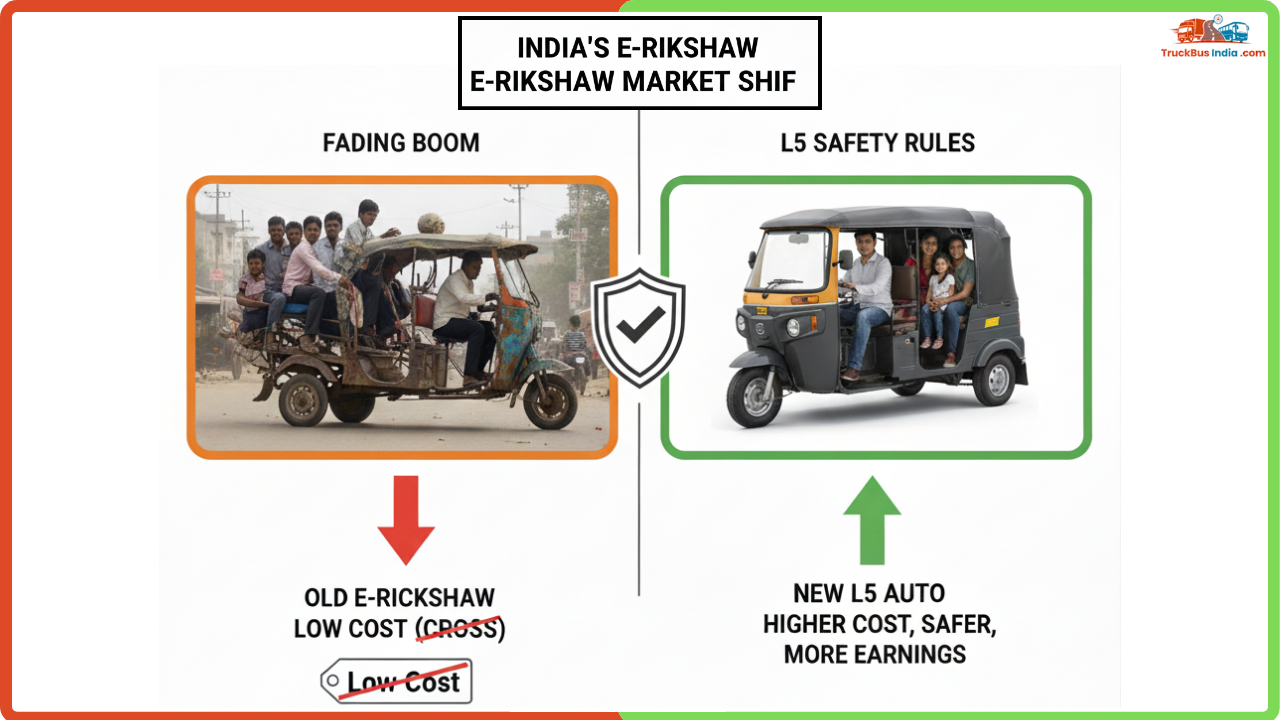

India’s once‑booming e‑rickshaw market — long hailed for its affordability and role in last‑mile transport — is showing signs of fatigue as new safety and regulatory shifts push buyers and drivers toward more robust L5 electric autos. Changes in homologation requirements, tighter incentives, and higher upfront costs are reshaping the landscape for three‑wheeler electrification.

From E‑rickshaw Growth to Market Slowdown

E‑rickshaws — battery‑powered three‑wheelers designed primarily for short, low‑speed routes — grew rapidly across India’s urban and peri‑urban areas due to their low purchase price and operating costs. However, recent industry data and market analyses reveal a clear e rickshaw market slowdown. The sub‑segment that once dominated last‑mile mobility has seen a marked reduction in growth as regulations and market preferences evolve.

The L5 electric auto upgrade — referring to a category of electric three‑wheelers with heavier build quality, improved safety, and better performance than traditional e‑rickshaws — is increasingly attracting buyer interest. These vehicles are built to meet stricter safety and homologation norms set out under updated Central Motor Vehicle Rules (CMVR) and type approval regulations. Compliance with such standards demands better chassis strength, battery safety systems, and more robust components, which in turn raises manufacturing costs and final vehicle prices.

How L5 Norms Shifted the Competitive Balance

Under the PM E‑DRIVE incentive scheme aimed at accelerating India’s electric mobility transition, funding allocations were revised to favor L5 category e‑3 wheelers more than traditional e‑rickshaws. While incentives for registered e‑rickshaws have been capped and reduced (for instance, lower per‑kWh support and total caps on eligible vehicles), the total outlay for L5 vehicles under the scheme was increased significantly. This has had a direct effect on buyer preference and vehicle economics.

For instance, the government limited the total pool of e‑rickshaws eligible for subsidies to around ₹50 crore, with smaller incentive caps per vehicle, whereas the L5 e‑3 wheelers drew a much larger portion of the scheme’s ₹857 crore outlay. Incentives for L5 vehicles registered in early periods were also higher per kWh than for traditional e‑rickshaws.

The net effect of these changes has been to tilt the cost‑benefit balance in favor of L5 autos — even though their upfront costs are significantly higher than typical e‑rickshaws. Buyers (often driver‑entrepreneurs and small fleet owners) see better long‑term value in L5 vehicles because their improved build quality, range, and earnings potential offset the higher initial expense.

Demand Dynamics and Buyer Preferences

With stricter L5 homologation norms, L5 electric autos are compelled to pass more rigorous tests, including structural safety and battery performance checks, leading to higher consumer confidence and potentially better durability. These factors appeal strongly to buyers who depend on the vehicle for daily income generation, even if acquisition costs are steeper.

In contrast, the legacy e‑rickshaw segment — mostly low‑cost models with basic features — is losing traction. Without safety upgrades or better compliance with formal vehicle norms, many of these vehicles are either operating informally or facing dwindling incentives, making them less attractive financially.

Market Impact and Industry Response

Industry players and manufacturers are rapidly adjusting their product lineups and sales strategies. Several OEMs are focusing more on L5 variants that align with updated regulatory requirements and better total cost of ownership over a vehicle’s lifecycle. This shift affects the entire three wheeler sales dip narrative — rather than a pure decline in EV adoption, it indicates a transition from low‑end e‑rickshaws to durable L5 electric autos suited for commercial use.

Additionally, policymakers and transport planners are increasingly emphasizing the need for safer, more reliable electric three‑wheelers, including possible star‑rating systems and audits of production facilities to eliminate substandard units. These developments, while improving quality and safety, also raise costs for manufacturers and buyers alike.

The Road Ahead

The trajectory of India’s electric three‑wheeler ecosystem is evolving. Where the market was once dominated by low‑cost e‑rickshaws, regulatory shifts and market economics are ushering in an era where L5 electric autos with stronger safety and performance credentials define growth. For buyers and small operators, this means a greater emphasis on vehicles that offer better long‑term return on investment, even if it demands a higher upfront price.

Ultimately, this transition reflects broader structural changes in India’s EV policy and mobility landscape — with safety, durability, and sustainability now at the forefront of three‑wheeler adoption decisions.