News List

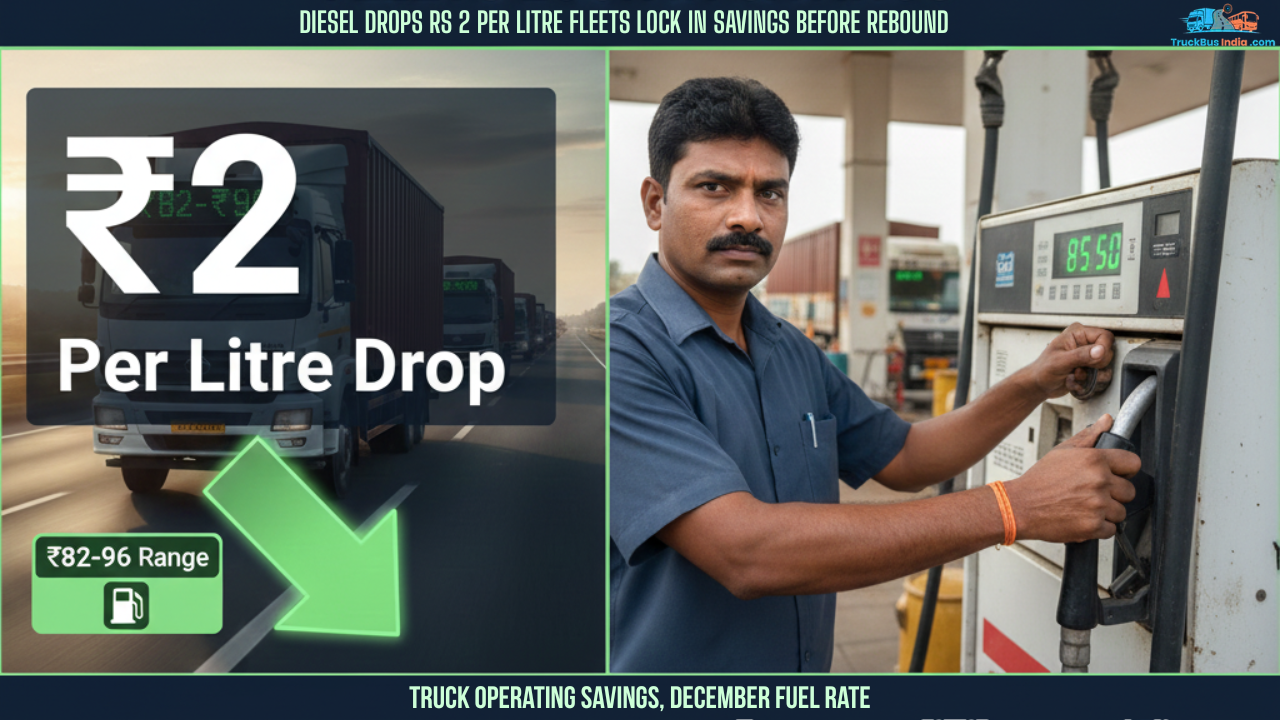

Diesel drops Rs 2 per litre, fleets lock in savings before rebound

In a significant move impacting commercial transport economics, the Indian government recently announced a Rs 2 per litre reduction in diesel prices across major urban centres. This downward adjustment, aimed at easing inflationary pressures and supporting transportation‑dependent sectors, comes at a time when global crude oil markets have shown volatility. The price drop has resonated strongly with fleet operators, particularly highway and logistics fleets with high diesel usage, as even modest retail fuel relief can meaningfully improve operating margins in a cost‑intensive environment.

How diesel prices have shifted in key Indian cities

Fuel pricing in India is dynamically adjusted based on global crude oil benchmarks, exchange rates, taxes, and regulatory policy. Following the cut, diesel prices in prominent markets have moved lower:

- In Mumbai, diesel is now around Rs 90.03 per litre.

- In New Delhi, rates stand at roughly Rs 87.62 per litre.

- In Chhattisgarh, diesel trades around Rs 94.32 per litre.

These figures reflect a net reduction compared with previous levels in late 2025, allowing long‑haul trucks and commercial vehicles to benefit from lower per‑litre fuel costs. While retail pricing fluctuates daily, the Rs 2 cut creates breathing room for transport operators ahead of potential future price rebounds driven by crude market shifts.

Why the diesel price cut matters for fleet economics

Fuel costs account for a major portion of operating expenses for heavy commercial vehicle (HCV) and logistics fleets. In long‑distance haulage, diesel can represent as much as 30–40% of direct trip costs, especially on routes exceeding 800 km. A reduction of Rs 2 per litre cascades throughout operational expenses:

1. Immediate reduction in per‑trip operating cost

For a truck that burns 30–35 litres per 100 km, a Rs 2 cut translates to around Rs 60–70 savings per 100 km—a tangible reduction when aggregated over total monthly kilometres.

2. Improved cash flows for small and mid‑sized fleets

Smaller operators with tighter margins feel fuel cost swings more than larger fleets. Reduced diesel rates help contain outflows and reduce the need to raise freight charges mid‑cycle.

3. Sharper competitiveness in freight markets

Lower operating costs can allow shippers to offer more competitive pricing for logistics contracts, helping Indian carriers remain cost‑effective against regional competition.

Overall, the cut gives fleets a short‑term cushion to optimise fuel budgets and strategic planning ahead of the next price cycle.

Drivers of the diesel price change

India’s retail fuel prices are influenced by:

- Brent crude and international supply dynamics

- Government tax and excise policies

- State Value‑Added Tax (VAT) and dealer margins

The Rs 2 per litre reduction reflects a policy choice to absorb parts of global crude movements into retail pricing structures. While global fundamentals sometimes push prices higher, occasional policy‑led reliefs help entrepreneurs in fuel‑dependent sectors manage costs more predictably.

Fuel pricing formulas also consider currency exchange rates and crude basis differentials. As global oil markets soften at times, OMCs and regulators may adjust retail rates to pass savings to consumers and strategic sectors.

Fleet strategies to capitalise on savings

With the diesel price cut in effect, fleet operators are adopting several tactical responses:

Lock in bulk diesel purchases – Some large operators pre‑book volumes at lower station prices to hedge against future fuel hikes.

Route optimisation – Lower fuel costs create an opportunity to refine routing strategies for shorter turnaround times and better asset utilisation.

Fuel card and digital solutions – Digital fuel card programmes help track consumption precisely and reinforce fuel discipline amongst drivers.

Maintenance scheduling – The cost buffer can allow fleets to prioritise preventive care, reducing breakdown risk and ensuring higher uptime.

These strategic moves help fleets turn temporary price relief into sustainable gains rather than treating the cut as a one‑off benefit.

Outlook: price rebound risks on the horizon

While the Rs 2 per litre cut offers immediate savings, diesel prices in India remain subject to market forces. Crude price rebounds—triggered by geo‑political instability, OPEC+ pact shifts, or tightened supplies—could push retail rates up again. Fleets should therefore use current relief as both a savings opportunity and a reminder to build resilience into fuel procurement planning.

In the current landscape, diesel price drop India has delivered welcome respite, but operators must continue to watch global markers and internal tax changes that shape fuel pricing in 2026 and beyond.