News List

RBI rate cut opens cheaper loans for truck fleet expansions now

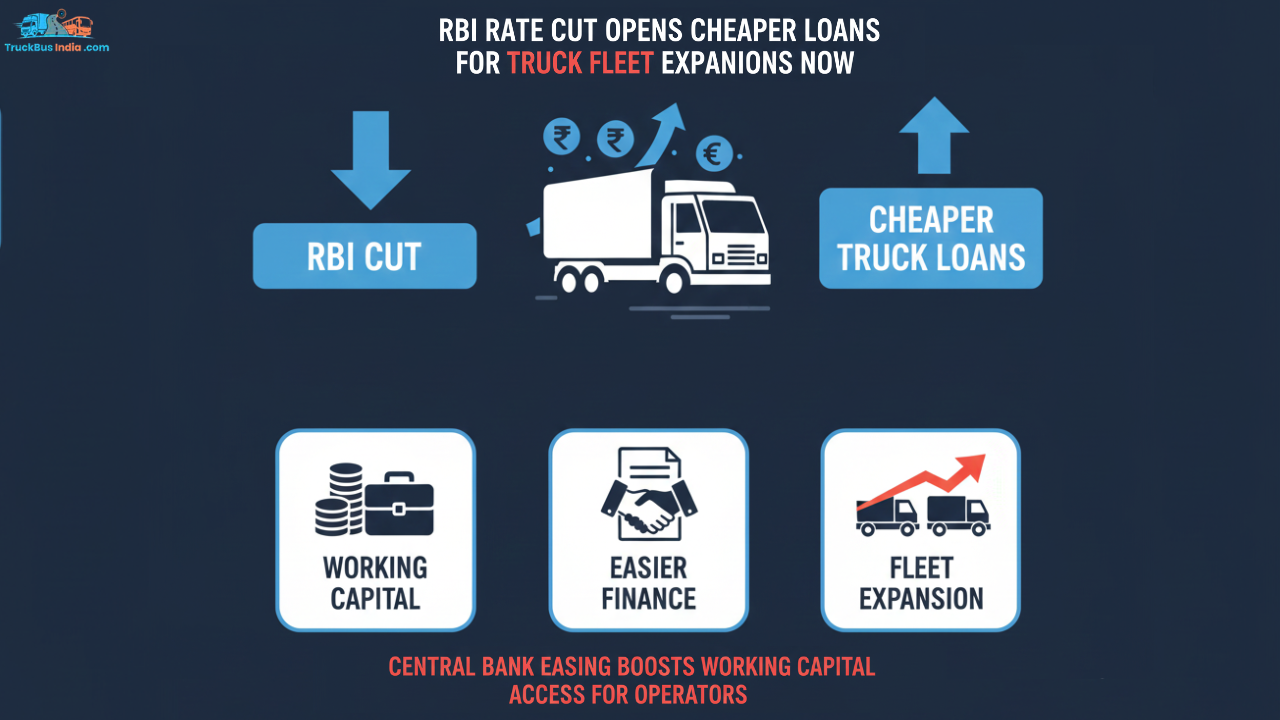

The latest RBI rate cut has eased borrowing conditions for the transport sector, offering timely relief to truck operators facing rising operating costs. By lowering the policy rate, the Reserve Bank of India has signalled a pro-growth stance aimed at supporting investment and liquidity across the economy. For fleet owners, this move directly translates into softer interest rates on new and existing loans linked to benchmark rates.

The impact is particularly relevant for road transport, where access to affordable credit plays a decisive role in fleet renewal and expansion decisions.

Cheaper truck loans boost fleet finance outlook

Following the RBI rate cut, lenders have begun recalibrating loan offerings across the commercial vehicle segment. Banks and non-banking finance companies are selectively passing on the benefit through reduced lending rates and improved repayment structures. This has made fleet finance in India more attractive for operators who had postponed purchases due to high borrowing costs.

Lower interest outgo improves project viability, especially for operators planning incremental fleet additions rather than large-scale expansion.

Working capital access improves for operators

Beyond vehicle purchases, the rate cut has also eased access to working capital for truckers. Transport operators rely heavily on short-term funding to manage fuel expenses, driver wages, toll payments, and maintenance cycles. With funding costs easing, trucker working capital pressures are expected to reduce, allowing smoother cash flow management.

This is particularly important for small and mid-sized fleet owners who often depend on credit lines to bridge payment cycles with shippers.

Commercial vehicle loans see renewed traction

Commercial vehicle loans are witnessing renewed enquiry levels as confidence improves post the rate cut. Replacement demand, in particular, is gaining momentum as operators look to upgrade ageing vehicles without significantly increasing monthly repayment burdens. Financing institutions are also focusing on asset-backed lending, where predictable freight income supports loan servicing.

This trend supports gradual capacity addition without triggering aggressive leverage across the sector.

CV expansion funding aligns with freight outlook

CV expansion funding is closely tied to freight demand visibility. With infrastructure projects, mining activity, and logistics movement showing steady momentum, operators are more willing to commit to new assets when financing costs are manageable. The RBI’s easing move helps align funding costs with expected freight earnings, improving overall return calculations for fleet investments.

Rather than speculative buying, most operators are adopting a measured approach, using cheaper credit to strengthen core routes and dependable contracts.

Rate transmission remains key for wider impact

While the policy rate cut is positive, the pace and extent of transmission by lenders will determine its full impact. Operators are closely tracking how quickly banks and NBFCs adjust lending rates and fees. Faster transmission would accelerate fleet modernisation and capacity upgrades across segments.

In the near term, the RBI rate cut has clearly improved sentiment in the trucking industry. Cheaper loans and improved liquidity provide fleet owners with a window to plan expansions, strengthen balance sheets,and prepare for upcoming freight opportunities without excessive financial strain.