News List

November retail auto data confirms CVs holding share in a mixed market

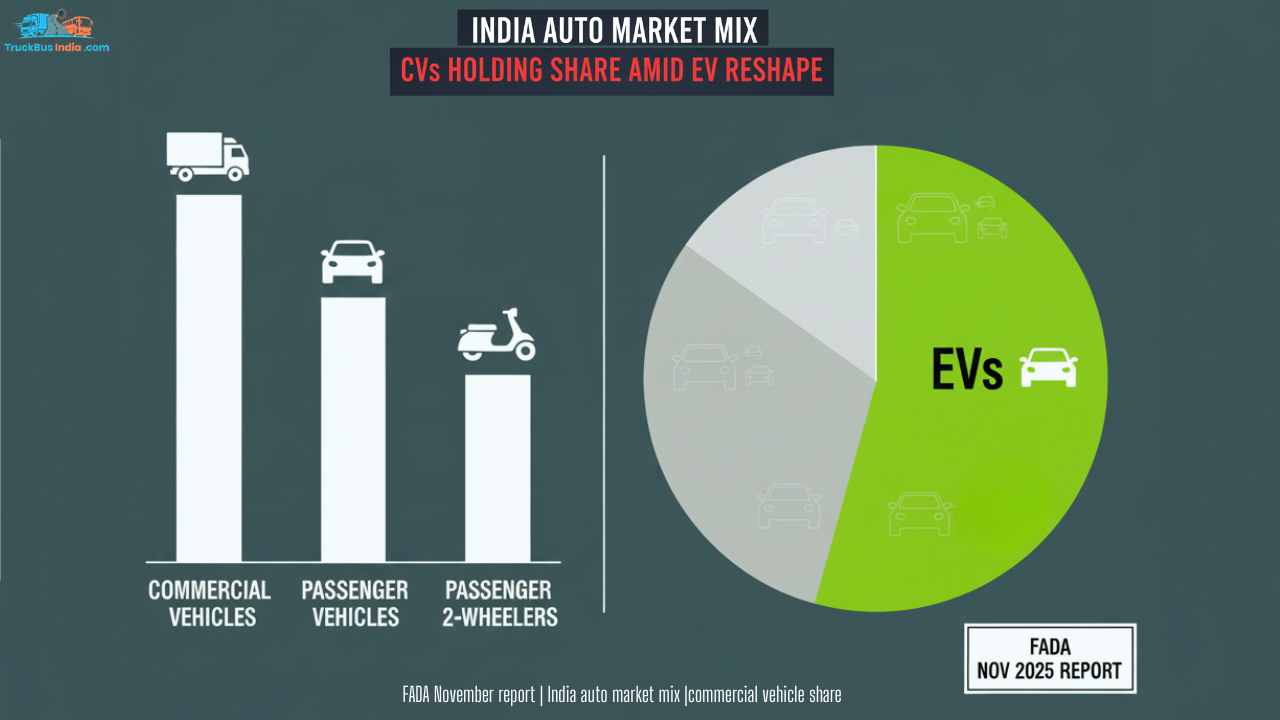

The November 2025 auto retail data highlights a market moving in two directions at once. Passenger vehicles and electric mobility continue to evolve rapidly, while commercial vehicles (CVs) have shown resilience by holding on to their retail market share. According to the FADA November report, overall auto retail volumes reflected cautious buying sentiment, influenced by selective financing, inventory management and regional demand variations.

Despite these headwinds, the CV segment managed to maintain its position within the India auto market mix, signalling steady demand from infrastructure, logistics and replacement-led purchases.

CV segment market share remains stable

The CV segment market share in November remained largely stable compared to previous months, even as growth momentum varied across other categories. Medium and heavy commercial vehicles benefited from ongoing road construction, mining activity and freight movement ahead of year-end demand. Light commercial vehicles, particularly those used for last-mile delivery, continued to see support from e-commerce and intra-city logistics.

This balance helped commercial vehicles defend their share, even as passenger vehicle demand showed signs of moderation in certain urban markets.

FADA November report points to demand discipline

Insights from the FADA November report suggest that CV retail performance was driven more by actual demand than speculative buying. Fleet operators remained cautious, aligning purchases closely with utilisation levels and confirmed contracts rather than expanding aggressively.

This disciplined approach helped prevent excessive dealer inventory build-up in the CV category, supporting stable retail numbers and healthier supply-demand alignment.

EV growth reshapes the wider auto mix

While CVs held ground, electric vehicles continued to reshape the broader India auto market mix. EV penetration increased steadily in two-wheelers and passenger vehicles, drawing attention and investment. However, in the commercial vehicle space, diesel-powered models still dominate retail volumes, especially in long-haul and heavy-duty applications where charging infrastructure and payload economics remain limiting factors.

As a result, the rise of EVs has not yet significantly eroded the commercial vehicle share, though it is influencing long-term fleet planning.

Replacement demand supports commercial vehicle share

Another key factor behind steady commercial vehicle share in November was replacement demand. Ageing fleets, higher maintenance costs and compliance requirements under BS6 norms are prompting operators to replace older vehicles selectively.

Rather than expanding fleet size, many buyers focused on upgrading efficiency and reliability, which translated into consistent retail activity without sharp volume spikes.

Regional variations shape November outcomes

The November 2025 auto retail data also reflected regional diversity. Infrastructure-heavy states and freight corridors reported relatively stronger CV demand, while regions affected by project delays or slower cargo movement saw muted buying. This uneven distribution underscores how closely CV retail performance is tied to economic activity on the ground.

Such regional patterns further explain why CVs were able to hold shares even when overall auto retail sentiment remained mixed.

Outlook for CVs in a changing market

Looking ahead, commercial vehicles are expected to continue defending their market share as long as infrastructure spending, logistics demand and replacement cycles remain active. While EV adoption will gradually influence the CV segment, near-term retail trends suggest a steady transition rather than abrupt disruption.

November’s data reinforces that, within a transforming auto landscape, commercial vehicles remain a foundational pillar of India’s mobility and economic ecosystem, holding firm even as the wider market evolves.