News List

India’s E-Bus Share to Double, Hit 12% by FY27

India’s electric bus market is poised for a major leap, with e-buses expected to make up 10–12% of new bus sales by FY27—double the current 5% share—according to India Ratings and Research. The surge will be driven by government-backed schemes, growing environmental commitments, and the lower total cost of ownership compared to conventional buses.

The country’s aggressive climate goals, including reducing carbon intensity by 45% by 2030 and achieving net-zero emissions by 2070, have placed cleaner public transport at the forefront. Road transport contributes 12% of India’s energy-related CO₂ emissions, and while trucks and buses represent only 4% of the total vehicle fleet, they account for almost half of total emissions, as per Niti Aayog.

To tackle this, the government has rolled out two major schemes: PM E-DRIVE and PM e-Bus Sewa. Launched in October 2024 with a ₹10,900 crore outlay, PM E-DRIVE aims to deploy 14,028 e-buses across nine major cities and develop charging networks by March 2026. It offers subsidies up to ₹10,000 per kWh, capped at ₹35 lakh per bus, mainly for state transport undertakings.

Complementing this is the PM e-Bus Sewa-Payment Security Mechanism, with a ₹3,435 crore budget to facilitate the rollout of over 38,000 e-buses between FY25 and FY29. The mechanism ensures timely payments to operators under public-private partnerships—a key step to encourage manufacturer participation and ease financing concerns.

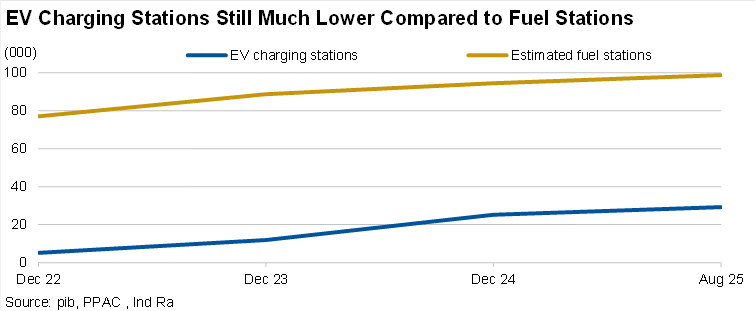

Despite the policy momentum, India’s e-bus industry continues to face hurdles. Charging infrastructure remains inadequate, private operators are largely excluded from subsidies, and manufacturers are grappling with supply chain bottlenecks. The country has fewer than one-third of the EV charging stations compared to conventional fuel outlets.

E-bus deliveries have also slowed due to shortages of critical imported components such as batteries, chassis, and powertrains. However, local manufacturing capacity is gradually expanding. The Ministry of Power recently approved ₹5,400 crore in Viability Gap Funding for 30 GWh of Battery Energy Storage Systems, projected to attract ₹33,000 crore in investments by 2028.

According to the International Energy Agency, e-bus penetration in India stands at just 5%, far behind China’s 60%, reflecting vast untapped potential. With state transport undertakings operating only 5–7% of registered buses, experts say private sector inclusion will be crucial for scaling adoption.

India Ratings emphasized that while policy support has laid a strong foundation, addressing infrastructure, financing, and supply chain challenges will determine how fast the electric bus revolution gains speed across Indian cities.